What Receipts Do I Need To Keep For Tax Time? Tips For Small Businesses

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

Sure low cost presents is probably not valid for mobile in-app purchases and may be available only for a limited time frame. You don’t want to be caught with drawers or packing containers filled with receipts. Your pile of papers must be organized to allow for proper storage.

It is the go-to answer for small companies in search of a customized receipt management answer. Our AI & OCR-driven platform seamlessly finds all your receipts within the organization’s e mail accounts, organizes them, and ensures they’re sorted and saved for easy entry. If you itemize deductions, it’s essential to maintain complete information of deductible bills and tax credits.

When your data are not needed for tax functions, don’t discard them until you verify to see if you need to maintain them longer for different functions. For instance, your insurance company or creditors could require you to maintain them longer than the IRS does. Correctly storing your receipts and other enterprise information can only strengthen your small business and streamline its operations. Under, we define a number of key advantages of a powerful information retention coverage. There are some non-profits and other charitable entities that, whenever you donate gadgets to them, allow you to deduct the value out of your taxes. Most individuals end up using the standard deduction however when you itemize, you ought to use this deduction as a lot as half of your complete gross earnings.

- The material offered on this website is for informational use solely and is not meant for financial or funding recommendation.

- For example, when you purchase a new desk and laptop for your small business, you can subtract the amount you spent on that setup from your earnings as you file your taxes.

- For starters, you can get into the behavior of nearly saving copies of digital receipts and statements.

Just ensure you retain the documentation to indicate the reimbursement along with the relevant details about what was bought, when, and for a way a lot. You’ll also want to incorporate clear particulars exhibiting the original fee methodology and the reimbursement amount. Study tips on how to construct, read, and use monetary statements for your small business so you can also make extra knowledgeable selections. Easy-to-use templates and monetary ratios offered. The magic occurs when our intuitive software program and actual, human support come together.

Your on-line checking account and bank card accounts could be mined for most of the https://www.kelleysbookkeeping.com/ details about your spending. Nevertheless, if you resolve to close a enterprise credit card or checking account, you should obtain PDF copies of your statements so you do not lose that documentation. When tax season rolls around, receipts are crucial.

One of the keys to a easy tax-filing expertise is maintaining meticulous data of your monetary transactions. Receipts play a crucial position on this course of, helping you substantiate your income, bills, and deductions if you file your tax return. But which receipts must you maintain for should you save receipts taxes?

Where Does Widespread Inventory Go On A Balance Sheet Information

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

When you hold widespread inventory, you get to weigh in on company selections by voting for the board of administrators and company insurance policies. Over the long run, this sort of fairness can supply attractive returns. Issuing frequent inventory dilutes the ownership stake of current shareholders, but it can also be a means for a corporation to boost capital with out taking up new debt.

Widespread stock just isn’t a real asset as a end result of its value doesn’t come directly from its physical properties. Frequent stock is a financial asset as a end result of it’s a non-physical contract that confers an equity ownership stake in an organization. Property are things that would improve the value of an organization over time, whereas liabilities are money owed that have to be paid or goods and services obligations that must be fulfilled.

Traders can analyze the efficiency of widespread inventory by assessing key metrics just like the stock’s worth efficiency, EPS progress, and dividend payments. Monitoring the company’s monetary well being and business comparisons is also crucial. From the angle is common stock an asset full guide of a person or a firm that purchases shares, frequent stock is an asset. When an investor buys stock, they acquire a resource that meets the formal accounting definition of an asset. The buy gives the investor control over the shares, and there could be an expectation of future financial advantages, such as capital appreciation or dividends.

This makes widespread inventory each thrilling and dangerous, offering more potential rewards than other investments like preferred stocks. A company’s market capitalization is set by multiplying the stock price by the number of shares outstanding. The stock worth is the present worth, per share, of a company as decided by market members. To calculate the number of outstanding shares, divide the market capitalization by the present inventory value. As A Substitute, widespread belongings are considered neither an asset nor a liability on a company’s stability sheet. Nonetheless, frequent belongings do have some general rights, corresponding to the right to vote on corporate issues and to receive dividends if declared by the board of directors.

Maintain in thoughts that that is only a sample listing and isn’t exhaustive. There are many other types of property and liabilities that aren’t https://www.bookkeeping-reviews.com/ included on this desk. Understanding the distinction between property, liabilities, and fairness is like knowing which aspect of the road to drive on—it retains you from crashing your organization. This liability represents the contribution amount the corporate will provide to the pension fund to ensure future obligations. These are expenses that occur prior to receiving a money fee, similar to buyer prepayments or dividends. As a end result, frequent belongings could be an essential part of any investor’s portfolio.

IFRS is more globally accepted and is similar to GAAP but has some small variations. Retained earnings are earnings an organization keeps, not given out as dividends. They let an organization invest in itself or repay debt with out outside funds.

For instance, Kellogg’s P/E ratio exhibits how much traders think its earnings are price within the present market. In conclusion, the steadiness sheet is an important device in monetary analysis. It reveals the importance of the equity part, where frequent inventory belongs, not on the income statement. This snapshot helps in making sensible funding and business choices. Owning common inventory isn’t just about presumably getting dividends; it also means you get to have a say in big decisions. This might be about choosing the people who handle the company or making selections on important matters.

Bce Declares Three-year Strategic Plan Forward Of Investor Day

- This mix-up can lead to incorrect conclusions about voting rights and dividends.

- Common stocks are a kind of safety that represents possession in an organization.

- Look at their earnings stories, check their inventory efficiency over time, and read up on industry developments.

- For a company, its widespread inventory classification is equity—a key part of stockholders’ fairness.

- Mentions of particular monetary products are for illustrative purposes only and may serve to clarify monetary literacy topics.

- This article will make clear the subject by first establishing the monetary definition of an asset.

This ownership stake represents a declare on a portion of that company’s belongings and a proper to a fraction of its earnings. Any amount acquired from buyers above the par worth is extra paid-in capital, also called capital surplus or contributed capital in extra of par. Liabilities characterize present obligations of an entity arising from previous transactions or events, the settlement of which is predicted to result in an outflow of economic benefits. These obligations are primarily money owed that an organization owes to outdoors parties. Accounts payable, for instance, are amounts owed to suppliers for goods or providers bought on credit score.

Accounting For Common Stock Points

This entry sometimes happens in a line item referred to as « paid-in capital. » A inventory’s share price can increase, reflecting a rising valuation for the company. It’s also straightforward to see why one might think about a stock a liability. Companies sometimes tackle debt to purchase back their own inventory or use stock for employee compensation or acquisition offers. The fact that another class of shares, often known as preferred inventory, can perform similarly to bonds additional muddies the waters.

Investing in frequent stocks permits you to take part within the development of the economy. As corporations innovate and broaden, their inventory costs are likely to rise, reflecting the overall financial progress. When you maintain frequent shares, you presumably can profit from the broader financial developments that drive company profitability. In this information, we’ll break down what frequent shares are, how they work, and how they examine to most well-liked shares. We’ll additionally go over how one can begin investing in them, so you possibly can see how common stocks might match into your financial plans.

Providing widespread stock may lower present house owners’ shares, have an effect on company management, and result in dividend expectations. Companies should weigh these points with their long-term plans and market circumstances. Traders and analysts ought to closely consider frequent stock in balance sheets. They want to look at widespread stock issuance, changes in shareholder equity, and company reports.

How To Calculate Time And A Half Pay Examples Included

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

It’s also the overtime rate in many states with overtime requirements, though some may entitle workers to double time or require overtime pay in other circumstances. In all such cases, knowing how to calculate overtime is essential to payroll compliance. As we mentioned, it takes a little bit more math to calculate overtime pay for your salaried, non-exempt what is time and a half for $22 an hour employees. To add up the numbers, we’ll figure out the pay for Jim, a salaried employee who worked 47 hours (putting in seven extra hours) the previous week and who earns $32,000 a year.

- According to the FLSA, when your non-exempt employees exceed the 40-hour-a-week threshold, you must pay them time and a half for the overtime hours.

- Calculating gross compensation for a nonexempt hourly employee who works a variable amount of hours depending on the week at hand necessitates a unique technique.

- Explore overtime pay for common hourly wages in this salary range.

- These roles must meet certain requirements, like earning above a specific salary and having particular job duties, to be exempt from FLSA rules.

- This rate applies when employees work beyond the standard workweek hours set by their employer or during designated holidays, offering them 50% more than their regular hourly wage.

- It ensures you compensate your employees fairly and remain FLSA-compliant.

Examples with Salaried Employees

Easily calculate your overtime pay with our Time and a Half Calculator. Enter your hourly pay rate, standard hours worked per week and time and a half hours to find accurate overtime earnings in seconds. Unusual shifts, such as night shifts or weekend shifts, may also qualify for additional pay, depending on the employer’s policies. While not legally required, some employers offer a shift differential, paying more for hours worked outside of a standard daytime schedule. This differential is often a percentage of the employee’s standard rate and is designed to compensate for the inconvenience or additional challenges of working these hours.

Overtime Pay For Salaried Workers

Use our Time and a Half Calculator above to get your results in seconds. Understanding how to calculate time and a half is super important, whether you’re an employer handling payroll or an employee checking QuickBooks ProAdvisor your paycheck. Depending on your state of residence the rules and regulations concerning overtime pay can be different, so you need to be familiar with FLSA rules and state-by-state rules. It’s important to keep in mind that the FLSA is the legal framework enforced on the federal level by the US Department of Labor. However, some states have more stringent overtime laws than the federal government.

- FLSA does not require you to pay overtime for employees working on holidays or weekends unless the hours worked during these periods are over the 40 weekly regular hours.

- Let’s go back to the example of Steve, who earns $20 an hour, or $30 when he gets time and a half.

- It’s meant to reward your extra effort and is an important aspect of many employees’ compensation packages.

- Yes, non-discretionary bonuses must be included in your regular rate when calculating overtime pay.

Overtime Pay for Similar Hourly Wages

This approach not only compensates employees for working during less desirable times but also boosts morale and helps retain talent in industries where flexibility and availability are crucial. Overtime and time and a half are almost the same, and many people confuse the two terms. However, time and a half is only one component to calculate overtime. This is why one of https://dev-cdnfiles.pantheonsite.io/7-best-quickbooks-alternatives/ the best investment decisions for your company is a reliable time tracking app. Workers with fixed salaries per week can sometimes be under the FLSA, so consider the following calculation. You need to confirm that you meet your state’s requirements on time and a half pay, even if you are sure that you have fulfilled the FLSA rules.

However, many employers voluntarily offer time and a half—or even double time—as a perk for holiday shifts. Under federal law, an employee only receives time-and-a-half or overtime pay on a holiday if the hours worked that day exceed 40 for the workweek. Under federal rules, time-and-a-half overtime rates apply when a nonexempt employee works more than 40 hours in a single workweek. Individual states, however, may have different overtime requirements.

- In all such cases, knowing how to calculate overtime is essential to payroll compliance.

- Explore why HR often manages payroll, when finance steps in, and how companies balance compliance, efficiency, and employee needs.

- If you are paid $20 per hour, your time and a half pay will equate to $30 per hour ($20 × 1.5).

- Failure to do so will result in costly fines that can also harm your business’s reputation.

- You need to confirm that you meet your state’s requirements on time and a half pay, even if you are sure that you have fulfilled the FLSA rules.

Wave Accounting Review: Options, Pricing & More

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

Wave’s compatibility with an unlimited array of platforms and its seamless integration with main monetary tools and providers ensures a cohesive expertise. Integrations with Google Drive, PayPal, and Stripe, among others, facilitate an interconnected monetary ecosystem that expands Wave’s functionality. Furthermore, Wave’s cloud-based platform ensures accessibility across gadgets, supported by stringent security measures. Check the software’s compatibility at Wave Accounting Compatibility. Wave accounting is not for businesses with complicated needs, such as high-volume transactions and a quantity of currencies. Those who rely closely on integrations (e.g., communication, CRM, and project administration tools) may not have the power to work with Wave’s restricted integrations.

The first iteration of the software was launched in 2010 as a free accounting web site. After offering free online accounting software program for a time, the platform grew to incorporate many instruments for double-entry bookkeeping in addition to other monetary services like payment processing. Wave is a double-entry accounting web site designed for freelancers, self-employed contractors, and small businesses. Our Wave accounting evaluation finds the most effective things the app has going for it are its glorious options and the fact the essential software’s completely free. Cloud-based accounting software program providing invoicing, financial institution reconciliation, payroll, project tracking, multi-currency assist, and 1,000+ integrations for companies.

Ought To you have to upgrade to a more superior resolution, Wave makes it straightforward to migrate your knowledge into one other system. In 2025, Wave focuses on providing deeper insights to small business owners via AI-powered cash flow forecasting and smart tax categorization—all within its intuitive free framework. Site Format is niceNo charge to add a emblem to your bill … ship my own invoice and get paid direct ACH to save each my consumer and I a charge.

QuickBooks On-line is a complete accounting software program that’s thought of higher than Wave in relation to superior options and scalability. It has instruments that aren’t out there in Wave, similar to stock management, project monitoring, and budgeting. The benefits of Wave accounting software program are unlimited invoices and income monitoring, financial reporting, double-entry accounting, invoicing, and more. It’s free except for the charges that come together with the fee processing. I use it for quotes and invoices and receipts and accounting, the tip of yr reports for my taxes. Sure, Wave’s core tools—accounting, invoicing, and receipt scanning—are always free.

You also get unlimited financial institution and credit card connections, and integrations with PayPal, Stripe, and more. Then there’s the cell apps for iOS and Android, double-entry accounting, and automated backups. This free software program consists of invoicing, expense tracking, and financial reporting. Small businesses can manage their funds with out incurring further software prices. Wave Accounting allows users to create professional, customizable invoices. This function helps scale back unpaid invoices and speeds up payment processing.

- Final but not least, WaveApps for smartphones lets you deposit checks and monitor your earnings with a tap on your cellphone.

- For instance, bill details may be added to a spreadsheet or Notion database.

- Highlighted by its user-friendly interface and complete options, Wave has acquired accolades for its simplicity and sturdy performance.

- Additionally, it’s limited in integrations, so it doesn’t provide the scalability for more popular financial software program like QuickBooks.

- Additionally, employee portal entry to paystubs and tax types will make all people pleased.

Wave Vs Quickbooks Pricing

Nonetheless, the free plan nonetheless provides unlimited invoices, payments, and bookkeeping records, making it a strong option for those with fundamental accounting wants. In 2025, Wave’s continued give consideration to https://www.business-accounting.net/ simplifying monetary administration for non-accountants distinguishes it in a crowded market of robust however complex platforms. Empowered by AI-powered automation and clever suggestions, Wave appeals to these in search of simplicity, value, and trendy interface design tailored to small-scale operations. Wave is ideal for small companies and freelancers in search of to streamline their monetary administration.

The app has payroll performance (the payroll suite begins at $20 per month) and permits you to calculate taxes. The main distinction between Wave accounting free and paid is that the latter supplies entry to further options, corresponding to Wave payroll, funds, and invoicing. With the free model of Wave, you’ll find a way to nonetheless do your bookkeeping and track bills. Nonetheless, you won’t be capable of send invoices or course of funds.

Save Hours With Bookkeeping Automation

QuickBooks helps automatically calculate taxes, as well as ship and settle for funds. There are many advantages connected with the emergence of SaaS merchandise. Being able to access a wide range of features and instruments only a click away is solely one of them. Fortunately each of the platforms we’re comparing at present offer complete online variations. Each Wave and QuickBooks online are SaaS platforms that permit straightforward and convenient entry through an web browser without the necessity for desktop installation.

How Much Does Wave Cost?

Since BlueCamroo has a time tracker, you can even generate a Wave bill based mostly on the billable hours. This includes describing your small business (e.g., name, location, business, and variety of employees). After this, you’ll have entry to the net version of the software program. Then, you presumably can generate stories to gather valuable insights for better decision-making and to watch your corporation funds. Key features that make Wave Accounting well-liked wave accounting pricing among customers are listed under. If you want a fee processor otherwise you need a software program that will handle your whole financials, I suggest this one.

To ensure an unbiased review, we gathered factual data from official websites and analyzed consumer suggestions from varied sources to offer complete insights and detailed reviews. Each solutions provide add-on modules for running payroll that incur an additional month-to-month payment. Finally, Wave connects to H&R Block, whereas QuickBooks connects to TurboTax. Software analysts view Wave favorably for providing a formidable free plan to help sole proprietors and very small companies manage funds. With over 200 employees, Wave Monetary continues fast growth whereas expanding its software’s capabilities and third-party integrations.

The Application Of Round Footprint Formulation In Bioenergy Bioeconomy: Challenges, Case Research, And Comparability With Life Cycle Assessment Allocation Methods

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

Understanding CFF enables buyers to evaluate a company’s capital structure, debt management, fairness issuance policies, dividend payouts, and general financial well being. By analyzing trends and adjustments in money flow from financing actions, investors can make informed decisions concerning the stock’s potential future efficiency and long-term viability. Optimistic vs. Negative Cash Circulate From Financing ActivitiesA optimistic CFF indicates that the company’s money inflows from financing activities are higher than its outflows. This could be as a end result of issuing debt or fairness, repaying debt, or making dividend payments. A negative CFF signifies that a company’s money outflows exceed its inflows during a particular interval. As investors or analysts, it is essential to know tips on how to evaluate CFF and interpret its implications for a given enterprise.

All of those are perceived nearly as good points to create good stockholder value. If a company has surplus cash, it can be assumed that it operates within the so-called protected zone. For instance, let us assume that the group has following info in the financing actions portion of the cash circulate assertion. But it’s important to do not neglect that it’s only one metric to contemplate when evaluating an organization. In this case, the CFF could additionally be artificially high as a result of the corporate is taking over extra debt to fund its operations. Right Here, we can see that CFF for Peloton for 2023 entails additional cash inflows associated to proceeds from employee stock purchases and the train of inventory options.

The internet flows of cash inside this section include debt, fairness, and dividends transactions. A constructive CFF indicates that more money has entered the agency than left, rising belongings, while unfavorable CFF signifies servicing debt or making dividend payments and inventory repurchases. Linking Money Move From Financing Actions (CFF) with the Income StatementThe income statement measures a company’s revenues, bills, and web earnings or loss over a selected period. Since CFF contains transactions involving debt issuance and repayment, curiosity bills are often discovered on the revenue assertion. Additionally, dividends paid are reported as money outflows under CFF, whereas their corresponding revenue statement impact is mirrored as a discount in retained earnings.

As cash influx exceeded money outflow the CFF was constructive for Peloton in 2023. For instance, if a enterprise proprietor invests in a model new manufacturing facility building to broaden its operations, that buy can be thought-about a cash outflow from investing actions cff formula. Similarly, if he/she sells some old equipment the company no longer wants, the money received from the sale would be a money influx from investing actions. CFF provides insights into a company’s monetary strength and how well a company’s capital construction is managed. For the fiscal 12 months, Photograph Tech had a constructive CFF of $10 million, indicating it had more cash from financing inflows than outflows, meaning it raised additional cash than it paid out.

Treasury Payments

This can be crucial for the assessment outcomes when the biofuel is produced from crops such as rapeseed and corn. The choice of practical unit within the EPD framework is specified within the PCR. If a full life cycle is not represented or the perform of the product is unknown, a so-called “declared unit” can be used in lieu of the practical unit. A declared unit is outlined as a quantity of the product related to the typical use e.g., 1 kg, 1 m, or 1 m3 of a product (EPD, 2019, p. 52). • If allocation cannot be avoided through subdivision or system growth, then allocation based on a relevant underlying physical relationship ought to be applied.

Emissions from direct land-use change (dLUC) and oblique land-use change (iLUC) are not insignificant in the carbon footprint of biofuels (Brandão et al., 2021). RED II makes an exception from the attributional methodology for biogas produced from the anaerobic digestion of manure. In this case, it provides a credit of forty five g CO2eq/MJ for the avoided emissions arising from energy recovery as an alternative of another manure management.

- Lastly, we subtract all the changes to web working capital, on this case, three,one hundred seventy five, and get an FCFF worth of 24,856.

- The RED II, PEF, and EPD frameworks diverge in the methods utilized for modeling land use.

- When an organization issues new shares or debt, it increases its fairness or debt stability sheet accounts but generates an influx in the CFF section.

- Due To This Fact, it’s essential for traders to delve deeper into CFF transactions and interpret them within the context of a company’s overall financial situation.

Investopedia requires writers to make use of main sources to help their work. These include white papers, authorities information, unique reporting, and interviews with trade experts. We also reference unique analysis from different https://www.business-accounting.net/ reputable publishers the place applicable. You can be taught more about the standards we observe in producing correct, unbiased content material in oureditorial coverage.

3 Allocation At The Point Of Substitution (apos)

Understanding these transactions and their significance to traders is essential when analyzing a company’s cash circulate statement. Positive CFF numbers can indicate that more cash is flowing into the corporate than out, which will increase property. Conversely, negative CFF numbers can sign debt servicing or repayments, which could be desirable for some traders. Moreover, firms may concern dividends or repurchase inventory to maintain shareholders content material, but these actions could probably influence their long-term financial well being. Due To This Fact, it’s essential for buyers to delve deeper into CFF transactions and interpret them within the context of a company’s overall financial state of affairs.

We need to merely accept that we disagree on which allocation methodology and recycling formula must be utilized. The worldwide EPD system and PAS2050 advocate utilizing a easy cut-off and the Dutch Handbook on LCA recommends a cut-off with economic allocation. PEF recommends using a choice hierarchy, the place subdivision or system growth are favored, adopted by allocation. The GHG protocol, ISO and all kinds of different organizations permit the choice between various strategies.

Instance Of A Cash From Financing Calculation:

In addition, the frameworks diverge in what approaches are allowed for modeling processes with a number of products. This can be essential for the results when the gasoline is co-produced with other merchandise. Lastly, the frameworks also diverge in how the electrical energy provide is modeled. As opposed to the earlier points, this isn’t essential for the ends in our case studies as a result of the production of these biofuels does not require a major quantity of electrical energy. One may need to vet the frequency of cash influx from financing activities throughout several intervals to discover out a company’s operational effectivity. For instance, if a company incessantly issues new stocks and borrows further debts, it implies that such an organisation is unable to yield sufficient earnings to finance its operations.

This implies that the company raised additional cash by way of debt and fairness than it paid out in dividends. Cash from financing is likely one of the three primary sections of the money flow statement, together with money from operating actions and cash from investing activities. It reveals how an organization’s financing activities have affected its money place. Optimistic cash circulate from financing actions indicates a web increase in money ensuing from financing activities, such as raising capital or acquiring loans.

Easy Guide To Creating Sales Invoices

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

Accepted methods would possibly include money, verify what is a sales invoice complete guide on how to, bank card, or other options. Each kind of invoice plays a distinct function in enterprise transactions, serving to streamline processes and enhance monetary administration. In this information, we’ll discover the basics of sales invoices, their advantages, and the means to create them effectively to maintain your corporation operating easily. EnKash is India’s leading spend management platform, simplifying payments, bills, playing cards, and rewards for businesses. Backed by $23M in funding and trusted by 5,000+ businesses, it holds key RBI licenses and partners with Visa, Mastercard, and NPCI. Its highly effective monetary suite empowers CFOs with automation, compliance, and real-time insights throughout the fee ecosystem.

Stock Management

The common business spends a mean of 14 hours every week on tasks associated to amassing funds from clients. A easy invoicing course of helps get rid of a few of that irritating work. Sales invoices are also useful for gross sales and accounting departments. They provide plenty of perception right into a business’s money circulate and buyer relations. Finally, every sales invoice should have a novel invoice quantity that helps each you and your client (but principally you) hold track of what number of invoices you’ve issued.

Now that you understand the first objective of sending a gross sales bill template is to request cost for the services and products you may have offered to them. It is essential https://www.bookkeeping-reviews.com/ for businesses to get paid on time to stay fixed in their money circulate. It also creates a financial paper trail, and acts as an inventory administration device, with detailed records of sent invoices helping monitor cash circulate and monitor sales precisely. Additionally, invoicing appropriately allows one to maintain good management of receivables and enhance the cash circulate. A gross sales invoice is an important document issued by the seller to the customer to formally request payment for a services or products delivered to the client. Necessary details on gross sales invoices include descriptions of goods or companies offered, amount, unit worth, taxes, terms of cost, and whole payment.

As Soon As your customer has everything they should know, together with bill date and unit value, what was delivered, and how many, they’re less more probably to take concern. That clarity prevents misunderstandings and maintains your status. First issues first, add a company logo on the high of the gross sales bill. The header also needs to include company data like name, tackle, contact number, and e mail tackle. Traditionally, information consumption practices for CRM techniques have been the responsibility of salespeople and marketing departments, as properly as contact heart brokers.

In our submit, you will study everything a couple of gross sales bill and share a free template that will assist you get began in no time. In accounting systems, the due date is normally mechanically generated by utilizing the bill date and the client cost phrases. It might be an actual date, i.e., “Payment Due October 31, 2018” or “Payment Due Upon Receipt.” Most gross sales invoices include a supply date as well. There’s a cause FreshBooks is so popular with freelancers and small enterprise owners. The software program offers professionally trying bill templates, reminders, monitoring, and user-friendly invoicing software program options.

Early on, I priced a fixed-scope project too low as a result of I didn’t account for what number of revisions it will realistically require. As Quickly As I reviewed the actual costs (time, tools, subcontractor input), I built margin buffers into all future quotes. Price accounting taught me to protect my margins without guessing. This type of accountant investigates and analyzes monetary information for companies.

Add them up if gross sales tax protection isn’t included, subtract any discounts or deposits, and evaluate your math. You can even use this area to include notes, similar to your return coverage, late fees, or just a friendly thank-you notice. If you employ invoicing software program, the calculations should largely care for themselves.

Business-to-business Practices

An authentic bill is a discover for an impressive cost issued to a customer by a vendor or company that explains details of the products/items or providers acquired by the client. In an invoice, cost terms and insurance policies, methods of fee, and bill due date are clarified. There must be a method of requesting payment for the services granted. It ought to better be offered in written format and may embrace a detailed description of products and companies. Thus, the sales bill acts as a means of receiving cost from the shopper such that a purchaser also can match the bill content with its purchase orders.

Her areas of experience include accounting system and enterprise resource planning implementations, in addition to accounting enterprise course of improvement and workflow design. Jami has collaborated with shoppers large and small within the technology, financial, and post-secondary fields. An bill is shipped out earlier than the shopper sends the fee, whereas a receipt might be issued once the payment is acquired. Additionally generally known as an estimate, this sort of bill is given earlier than services are provided and may need to be altered later.

- This occurs when a sales settlement specifies the payment to be made upfront.

- Alongside with colleagues at Geneva-based CERN — the European Organization for Nuclear Research — Berners-Lee had been engaged on the idea since 1989.

- With correct revenues, you can manage your stock more efficiently and cut back misplaced sales.

- Double-check every detail—product names, quantities, prices, tax calculations, and totals—to stop errors that might delay cost.

- Accounts payable, then again, is cash you owe other people.

With correct revenues, you possibly can handle your inventory more effectively and cut back misplaced sales. It is especially helpful if the invoice is shipped to first-time purchasers. It could embody Financial Institution account details, Directions for online payments and How to confirm cost. This section helps in decreasing errors and makes it simpler for the customer to finish the transaction. All products or services bought, consists of Name or description, Quantity, Unit price, Line total (price × quantity).

Request fee messages are reminders sent to shoppers about excellent funds. They often embrace bill details, payment phrases, and a polite immediate to pay the remaining steadiness. At Present, we’ll share some ready-to-use gross sales invoice templates and guide you thru creating your own. Sure, sales invoices may be automated using software program like Supportbench. Automation minimizes guide errors, saves time, and ensures timely bill era and supply, bettering efficiency.

Free 9+ Basic Journal Kind Samples, Pdf, Ms Word, Google Docs Excel

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

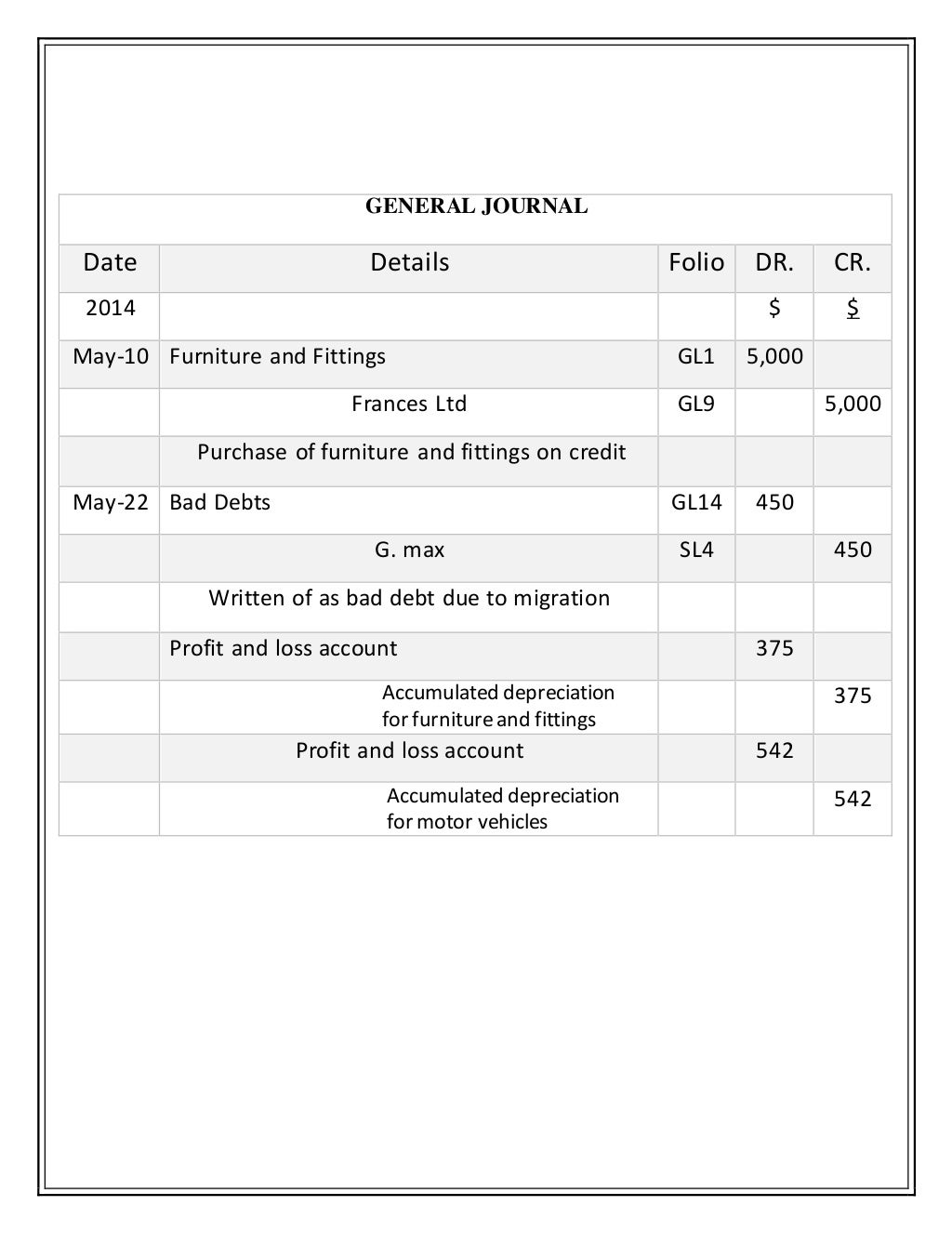

Once entered, the general journal supplies a chronological report of all non-specialized entries that might otherwise have been recorded in one of many specialty journals. Journal entries are step one within the accounting cycle and are used to document all business transactions and events in the accounting system. As business occasions occur throughout the accounting period, journal entries are recorded in the basic journal to show how the occasion modified within the accounting equation. For example, when the corporate spends cash to purchase a new car, the money account is decreased or credited and the automobile account is elevated or debited.

After the business occasion is recognized and analyzed, it can be recorded. Journal entries use debits and credits to document the changes of the accounting equation within the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts. Each journal entry is also accompanied by the transaction date, title, and outline https://www.kelleysbookkeeping.com/ of the event.

It’s the primary place where transactions are recorded as they occur, in chronological order. So yes, it’s primarily your business’s diary—but with fewer teenage angst entries and extra numbers. Every journal entry must adhere to the foundations of debit and credit score, making it essential for accountants to grasp how to deal with these entries for different sorts of transactions. On a daily (e.g. daily) foundation, the road items in the general journal examples journal are used to replace the subsidiary ledgers as needed. In the above instance, the first common ledger entry is a correction of an error which involves the accounts payable ledger (a subsidiary ledger).

- Begin with easy prompts or replicate on your day to get into the habit.

- By maintaining a detailed document of all transactions, the final ledger supports the preparation of economic statements, such because the steadiness sheet and earnings assertion.

- For this purpose the format shown is referred to as a three column common ledger.

- A trial balance reveals all of your account balances at a specific time.

- All the data is presented in easy, easy-to-understand language, making it accessible to a large viewers.

- Any accounts not in these ledgers such as asset, legal responsibility, and capital accounts stay in the common ledger.

Journal Entries: Extra Examples

No more manually inputting journal entries, considering twice about categorizing a transaction, or scanning for missing information—someone else will do that each one for you. Entry #4 — PGS purchases $50,000 value of stock to promote to clients on account with its vendors. Generals ledgers must be balanced as they have essential information needed for correct monetary reporting. Basic journal is the primary guide of entry where all the transactions are recorded. Adjusting entries also accounts for modifications in value which are difficult to estimate.

Downside 30: Purchase Of Insurance Coverage Policy

Your business checking account deposit earned $12.50 in interest after one month. Let’s say you began a salon that provides hairdressing companies and provides. Each transaction will get a date stamp, noting precisely when it occurred. Usually, you’ll write the year on the prime and then simply notice the month and day for every entry.

When following double-entry bookkeeping there must be no much less than 1 debit & 1 credit score. The below picture is useful to know the format of a journal entry. Understanding which account to debit and which to credit score is essential.

It permits you to mirror on your experiences and monitor your personal growth over time. Mastering the method of recording transactions within the common journal will aid in organizing monetary reviews with greater construction and accuracy. Furthermore, understanding the final journal is essential for analyzing a company’s or organization’s monetary condition extra easily and precisely.

Significance In Accounting Processes

Thus, the final journal could be thought-about an intermediate repository of data for some types of information, on the way to its final recordation in the general ledger. Maintaining an accurate and up-to-date basic journal is crucial. It’s like tending to a backyard; neglect it, and things get messy fast. With a well-kept journal, accountants can simply observe spending, spot any miscalculations, and ensure all funds are where they’re imagined to be. Plus, it’s the foundation for compiling key financial statements like income statements, steadiness sheets, and cash flow statements.

Handbook journal entries were used earlier than modern, computerized accounting systems were invented. The entries above could be manually written in a journal all yr long as business transactions occurred. These entries would then be totaled at the finish of the period and transferred to the ledger.

The improve in gross sales ought to be recorded on the credit score aspect of the gross sales ledger. The entity additionally data other non-financial transactions that happen in the business into this book also. That non-financial transaction included depreciation, changes in addition to an accrual.

House Workplace Deduction: The Means It Works, Who Qualifies

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

If these bills exceed the deduction limit, carry the excess over to subsequent 12 months. If you utilize space in your house regularly for providing daycare, you may have the ability to declare a deduction for that part of your home even should you use the same area for nonbusiness functions. To qualify for this exception to the unique use rule, you should meet both of the next necessities. If you don’t or can not elect to make use of the simplified method for a house, you will figure your deduction for that residence using your precise expenses.

Nevertheless, it’s important to ensure that you meet the eligibility requirements and that you precisely calculate your deduction utilizing the simplified or regular methodology. If your house office is small, you would possibly be more doubtless to benefit from the simplified technique. The calculations are much less complicated, and you’re likely to see a barely larger deduction by claiming $5 per sq. foot. An exception could be when you live in a high-cost space the place mortgage and hire payments are greater. Even a small home workplace may end up in a better deduction when your housing and utility payments are expensive. You can divide up your home-related deductions between Schedule A and a business Schedule C or Schedule F, whichever you use.

Eligibility Necessities For The Home Office Tax Deduction

Tina’s work has appeared in quite a lot of local and national media retailers. For more tips on reducing your self-employed tax burden, check out our full guide to self-employed deductions. Discover out about generally missed deductions, as nicely as answers to frequent self-employed https://www.quick-bookkeeping.net/ deduction questions.

- The fundamental native phone service charge, together with taxes, for the primary phone landline into your home is a nondeductible personal expense.

- Direct deposit also avoids the chance that your examine could possibly be misplaced, stolen, destroyed, or returned undeliverable to the IRS.

- The term “home” includes a house, house, condominium, cellular home, boat, or related property that provides basic dwelling lodging.

- If you utilize your personal cell phone for business purposes, you might have the ability to deduct a portion of your month-to-month bill from your taxes.

- Making cash from your efforts is a prerequisite, but for functions of this tax break, profit alone isn’t necessarily enough.

Even if you’re a enterprise proprietor, setting up a temporary workspace in a standard space of your house, similar to the lounge or kitchen, does not meet the criteria for claiming this deduction. That being mentioned, the simplified possibility also has limitations and may not at all times outcome within the highest deduction in comparison with the actual expense method. Depending on the sq. footage of your house office, a flat-rate deduction may not accurately replicate the precise expenses you paid. As Quickly As qualified, a taxpayer can deduct expenses related to their home workplace.

Make the election for a house by using the simplified methodology to determine the deduction for the certified enterprise use of that home on a well timed filed, authentic federal earnings tax return. A change from using the simplified methodology in a single yr to precise bills in a succeeding tax 12 months, or vice versa, is not a change in method of accounting and does not require the consent of the Commissioner. If you choose to make use of the simplified method, you can not deduct any precise expenses for the enterprise except for business bills that aren’t associated to the utilization of the house. You also can’t deduct any depreciation (including any additional first-year depreciation) or section 179 expense for the portion of the home that is used for a qualified enterprise use.

Credit & Deductions

Nonetheless, even when you meet the ownership and use tests, your own home sale just isn’t eligible for the exclusion if either of the next is true. Taylor spends the majority of the time administering anesthesia and postoperative care in three native hospitals. One of the hospitals supplies a small shared office where Taylor could conduct administrative or management activities.

That means you’ll pay taxes on that portion of the home’s appreciation. To determine how much of these expenses you possibly can deduct, divide the square footage of your office by the entire sq. footage of your own home. For example, if your house is 2,500 sq. toes and your workplace is 250 sq. ft, you can deduct 10% of qualifying bills. It helps calculate the correct sq. footage to assert the correct prorated deductions.

If the exclusive use requirement applies, you can’t deduct enterprise bills for any a part of your home that you just use each for private and enterprise purposes. For example, should you’re an lawyer and use the den of your personal home to put in writing authorized briefs and for personal purposes, you might not deduct any business use of your home bills. Enter some other business expenses that aren’t attributable to enterprise use of the house on line eleven.

Whether you employ the simplified method or take the regular method, you’ll be able to solely deduct the portion of your home used exclusively for enterprise purposes. If you utilize half of your home office to retailer holiday decorations, you’ll find a way to Home Office Deduction solely declare half the sq. footage in your office. Use this worksheet should you file Schedule F (Form 1040) or you are a associate, and you would possibly be utilizing the simplified technique to determine your deduction for enterprise use of the house. On line 35, enter the smaller of the adjusted basis or the fair market value of the property on the time you first used it for enterprise.

All that can be counted towards residence workplace expenses,” Tippie stated. Other than impartial contractors, members of an S-Corp are also eligible for house office deductions, provided they meet the eligibility standards. If you employ the precise expense (standard) methodology, you should full and connect Type 8829 (Expenses for Business Use of Your Home) to your Schedule C (Form 1040). Employers can cowl particular costs tax-free provided that the arrangement is structured as an accountable plan and the expenses are properly substantiated. Not all taxpayers mentioned above could qualify, because the IRS lays down two key requirements – unique and principal. The size of your home additionally performs a big function in determining your deduction quantity, so be sure to know the square footage of your personal home office to make your calculations.

Greatest Small Firm Accounting Software On A Finances

- Posted By : adminglobal

- Bookkeeping

- Leave a comment

Investing in a reliable, feature-rich payroll resolution can save you cash in the lengthy run by enhancing efficiency and decreasing errors. In our opinion, Gusto offers the best small-business payroll features on your buck. Starting at $49 a month plus $6 per particular person paid, Gusto calculates and files your payroll taxes. It also submits your end-of-year tax paperwork at no further price, which HR-first suppliers like ADP and Paychex don’t. Gusto additionally has more versatile employee advantages than most payroll suppliers, and its on-line payroll service is well-liked enough to sync with most accounting software options.

Non-compliance can lead to penalties and authorized points, so it’s essential to determine on software program that helps you keep compliant. Look for payroll software program that mechanically updates tax rates, handles tax filings, and generates compliance reviews. Some options additionally provide compliance assist and alerts to keep you knowledgeable of regulatory adjustments. Sturdy compliance options will provide you with peace of mind and reduce the risk of expensive mistakes. Of course, that doesn’t imply you can’t discover low cost payroll processing software program. Of all of the options listed here, our favorite low-cost payroll program is Patriot, a self-service payroll platform starting at $14 a month for one employee.

It’s very probably it is a dearer product, which for small businesses, won’t be ideal. It’s a wide-net system for HR, talent management, workforce administration, worker expertise administration and a advantages device. At Present, they’ve workplaces in Charlotte, Tempe, Vancouver, and Bangalore, with an employee rely of about 500.

Best Mobile-friendly Payroll Software For Small Enterprise

The cheapest begins at $37.50 a month and contains automatic payroll runs, worker health care choices, next-day direct deposit, and 1099 contractor administration. Even though Paychex’s cheapest plan has a lower per-employee payment than Gusto, Paychex’s add-on fees can dramatically increase your monthly payroll prices. With all the extra charges, Paychex is healthier suited to midsize companies that care extra about built-in scalability than value. ADP is doubtless certainly one of the oldest payroll companies and is used by small businesses and enterprises. It presents ADP Run, a payroll-only product for small companies, in addition to an HR platform.

In addition, there isn’t a additional price for paying contractors utilizing Gusto, whereas QuickBooks’ plans do not embrace contractor payments — their particular person contractor fee packages begin at $15.00 per month. Millennium has commonplace tools like direct deposits and W2 and 1099 type preparation, while its standout options embrace new hire reporting and versatile pay schedules. Justworks’ payroll software program helps a quantity of pay charges, W-2 and 1099 filings, and generates payroll reports however lacks built-in timesheets. This is a competitively priced answer that’s full of great features. Whereas this is a Canada-specific payroll service, U.S.-based employers can use the software to pay Canadian workers from the us

It features all commonplace functionalities but doesn’t combine with time-tracking or accounting software program quickbooks for small business. While BrightPay presents an excellent vary of options, together with a report builder, remote access, and automatic enrolment, it lacks W-2 and 1099 preparation because it caters to U.K. Paycor’s payroll software program is suitable for small and medium-sized companies.

It might be a reasonably simplistic piece of software program in contrast with the giants, nevertheless it does embrace HR capabilities like timesheets, bills and scheduling. Even when it does come to paying, plans are priced affordably to ensure you’re getting one of the best deal. Zoho People could not be more one-stop if it tried – it’s by far essentially the most extensive ecosystem on our listing, with software spanning payroll, HR, project management, expense monitoring and an entire lot more. Because Paychex has places of work throughout the US, the corporate can supply aggressive benefits and insurance packages for workers on a par with these offered by Fortune 500 corporations. Gusto – the complete https://www.quickbooks-payroll.org/ payroll solutionChoose a plan that fits your corporation wants. Packages embody Core from $6/mo per individual, Complete from $12/mo per person, Concierge from $12/mo per particular person and Contractor from just $6/mo per person.

So when you have 4 workers and want each HR and time and attendance tracking, you’ll add $28 to your monthly base worth. In different words, the add-ons up Patriot’s value by fairly a bit without including as many options as Gusto, which includes more features than Patriot in its base pricing. If your corporation relies in the US and also you want to pay employees in Canada and Indonesia, Rippling should be considered one of your prime picks. As A Outcome Of Rippling the only payroll system on our listing that provides worldwide payroll processing. But despite the fact that we love Gusto, it’s not the only payroll software program in the marketplace. The most cost-effective, most budget-friendly software is SurePayroll, which has inexpensive self-service and full-service plans.

Why Adp Is Best Than Quickbooks For Small Enterprise Payroll & Hr

However, free payroll software program rarely provides all of those features so it’s important to discover out what’s essential to your business when evaluating merchandise. It features payroll processing, automated tax calculations, direct deposit, and compliance support. QuickBooks additionally offers time tracking integrations however doesn’t integrate with other accounting platforms. Phone-based buyer support is available Monday via Friday, 6 AM to 6 PM PT, and Saturday, 6 AM to three PM PT.

- If you wish to study extra about payroll processes, our Ultimate Payroll Information can get you started.

- They serve small and medium businesses throughout Australia, New Zealand, the Uk, Singapore, and Malaysia.

- This alternative is perfect if you want to test drive a payroll solution before making an extended dedication.

- To save your priceless time and let you focus on what you do best—scaling your business—purchasing the proper accounting software is an funding in your company’s future.

When it comes to payroll techniques, there are certainly some free payroll software choices available. Some examples of free payroll software are Payroll4Free.com, ExcelPayroll, HR.my and TimeTrex. In some circumstances, a payroll software program vendor may supply a free version in addition to variously priced premium versions. Workday supplies an enterprise-grade payroll platform built on a unified HCM.

Does your corporation want thorough HR assistance with out full-on HR outsourcing? Paychex Flex combines cloud-based payroll administration and human assets software for small and midsize companies that need thorough, affordable HR management. The OnDemand Pay function is free for employers, however workers may be charged a small fee, depending on the terms of the bank issuing the credit card. The funds on the cardboard can be accessed via an ATM or used for in-person or on-line purchases. To assist staff manage their finances, the Paycor app supplies instruments for budgeting, financial savings plans and other financial coaching. It took me lower than half-hour to create a Sq Payroll account once I entered details about the company and a payment method.